property tax assistance program montana

Tax forms available from Department of Revenue. PO BOX 200528 MONTANA HOUSING HELENA MT 59620-0528 P.

Property Tax Help Montana Taxed Right Consulting Llc

Click here to learn about property the tax relief programs offered by the State of Montana.

. 4068412702 Toll Free. You have to meet income and property ownershipoccupancy requirements every year. This presentation gives an overview of the role the Montana Department of Revenue DOR through its Property Assessment Division PAD plays in maintaining the property tax record in each county of the state.

To be eligible for the program applicants must meet the requirements of 15-6-302. F orm PPB-8 Property Tax Assistance. Property Tax Relief If you are low income a 100 disabled veteran or surviving spouse or had a large increase in your property taxes due to reappraisal you may qualify for tax assistance.

This program applies solely to the first 200000 of the primary residences market value. Montana Disabled Veteran Assistance. Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax rates on their homes.

4219401 - PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM. For agricultural and timber parcels the only eligible land is the. Property Tax Assistance Program Application Form PTAP Home Memphis Documents Posts Property Tax Assistance Program Application Form PTAP September 2 2021 by Montana Department of Revenue.

The home or mobile home on a foundation must be owned or under contract and the owner must have lived there for at least seven months during the preceding year. HOMEOWNER ASSISTANCE FUND PROGRAM OVERVIEW. 21032 or less for a single person or 28043 or less for a married couple.

Property Tax Assistance Program. GENERAL PROPERTY TAX PROVISIONS. Among its duties the PAD administers property tax assistance programs.

Montana Disabled Veteran Assistance Program MVD. Assistance programs affect the property tax bill. Land Value Property Tax Assistance Program.

Helena The Montana Department of Revenue wants to let property owners know about a change in state property tax assistance programs to make it easier for taxpayers to apply for reduced property taxes. Property Tax Assistance Program PTAP Application for Tax Year 2018. If you are already approved for the Property Tax Assistance Program you will not need.

We have multiple programs available to help Montana citizens who need assistance with their income or property tax. If you are already approved for the Property Tax Assistance Program you will not need to apply again. We last updated the Property Tax Assistance Program PTAP Application in February 2022 so this is the latest version of Form.

Flathead County Treasurer290 A North MainKalispell MT 59901. You may use this form to apply for the Property Tax Assistance Program PTAP. The Homeowner Assistance Fund.

4219406 EXTENDED PROPERTY TAX ASSISTANCE PROGRAM EPTAP REPEALED See the Transfer and Repeal Table History. The tax roll is prepared and. 1 There is a property tax assistance program that provides graduated levels of tax assistance for the purpose of assisting citizens with limited or fixed incomes.

4219401 PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM. The benefit only applies to the first 200000 of value of your primary residence. Land Value Property Tax Assistance Program.

More about the Montana Form PTAP Other TY 2021. Latest version of the adopted rule presented in Administrative Rules of Montana ARM. 4 The property tax exemption under this section remains in effect as long as the qualifying income requirements are met and the property is the primary residence owned and occupied by the veteran or if the veteran is deceased by the veterans spouse and the spouse.

2 The first 200000 in appraisal value of residential real property. The taxpayer must live in their home for at least seven months out of the year and have incomes below 21262 for one eligible owner or below 28349 for a property with two eligible owners. The American Rescue Plan Act passed by Congress and signed by the president contains 9961 billion nationwide for a Homeowner Assistance Fund HAF.

Apply by April 15. Property tax assistance program -- fixed or limited income. The reduction depends on.

The Montana Homeowner Assistance Fund will include 50 million in federal funding allocated by Congress. Property Tax bills are mailed in October of each year to the owner of record as their name and mailing address appear on the tax roll. Property Tax Assistance Program PTAP will reduce your tax obligation if you meet the following income guidelines.

Property owners who already benefit from the Property Tax Assistance Program PTAP or Montana Disabled Veteran MDV program do not have to. Property Tax Assistance Programs. A new Montana property tax assistance program is designed to help residential property owners whose land value is disproportionately higher than the value of their home.

The Property Tax Assistance Program PTAP was created for property owners who need help paying off their taxes which can be quite high considering the amount of land that you can purchase in Montana. That funding will help Montanan homeowners and homeowners across the country remain in their homes. You may use this form to apply for the Property Tax Assistance Program PTAP.

HOMEOWNER ASSISTANCE FUND PROGRAM OVERVIEW. 4219401 - PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM. View or Pay Property Taxes.

Land Value Property Tax Assistance. A is the owner and occupant of. 1 The property owner of record or the property owners agent must make application to the local department office to receive the PTAP benefit provided for in 15-6-305 MCA or the MDV benefit provided for in 15-6.

PTAP is designed to assist citizens of Montana who are on a limited or fixed income. The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households. PTAP provides this assistance to these.

Tax Breaks For Montana Property Owners Inspect Montana

Montana Income Tax Mt State Tax Calculator Community Tax

Property Montana Department Of Revenue

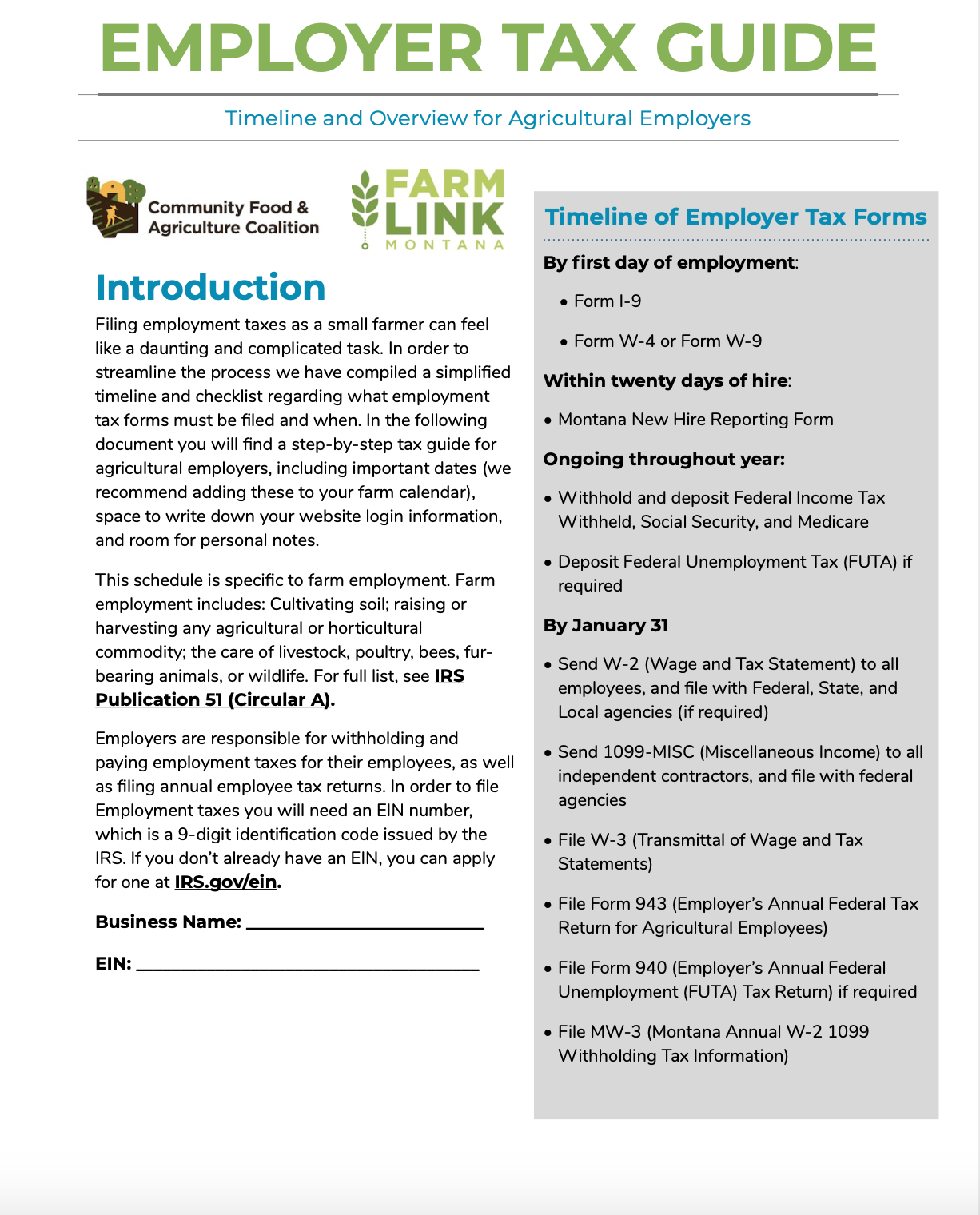

Farm Tax Information Farm Link Montana

Did You Receive Your Property Appraisal Notice Here S What It Means And What You Can Do About It Missoula County Blog

Tax Relief Programs Montana Department Of Revenue

Property Tax Help Montana Taxed Right Consulting Llc

Ci 121 Montana S Big Property Tax Initiative Explained

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana Income Tax Mt State Tax Calculator Community Tax

Tax Breaks For Montana Property Owners Inspect Montana